Much of the attention on the impact of artificial intelligence (AI) focuses on its potential to supplement or replace jobs and increase productivity.

However, the adoption of AI in a range of applications in major economies could also affect the financial markets by lifting real interest rates and bond yields, as well as driving stock prices.

Let’s explore how this could happen.

AI Could Lift Real Interest Rates and Bond Yields

Real interest rates, which are adjusted to take inflation into account, are related to an economy’s real rate of economic growth and the share of profit flowing to owners of capital. Investments in AI are set to enhance productivity, supporting economic growth in the countries that are positioned to capitalize on the benefits, in turn boosting real interest rates, according to an analysis by Capital Economics (sign-up required to read the report).

The real interest rate in an economy is negatively related to the overall savings rate, which could fall on expectations of higher future income amid AI-fuelled economic growth. However, there is a possibility that the savings rate could rise if the owners of capital or skilled labor benefit more than unskilled labor, as they tend to have higher savings rates.

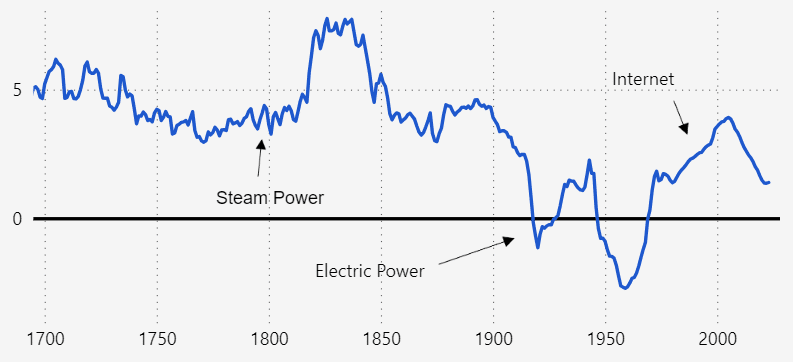

An increase in real interest rates would continue the pattern seen in previous technological revolutions, according to Capital Economics.

Estimates from the Bank of England show that long-run real interest rates typically rose in the aftermath of technological breakthroughs as the benefits of the new discoveries filtered through the economy.

Real sovereign bond yields are also likely to remain above the average level seen over the past decade, as they are mainly a function of expectations for real short-term interest rates.

Capital Economics projects that “equilibrium rates and ‘safe’ bond yields will be higher than in the pre-pandemic decade, but not dramatically so, and that the increase will be gradual.”

“We suspect that the US 10-year Treasury yield will rise from an average of 2.4% in the 2010s to around 4.0-4.5% in the 2030s, with the real yield rising to around 1.5-2.0%.”

While higher bond yields would typically exert downward pressure on equity market valuations, which are considered to be higher risk, this is likely to be more than offset by faster corporate earnings growth over time.

AI adoption could increase company earnings while reducing labor share at a faster pace than overall output, driving faster growth in stock prices. The boost to equities is likely to be concentrated among the providers of AI in the technology sector.

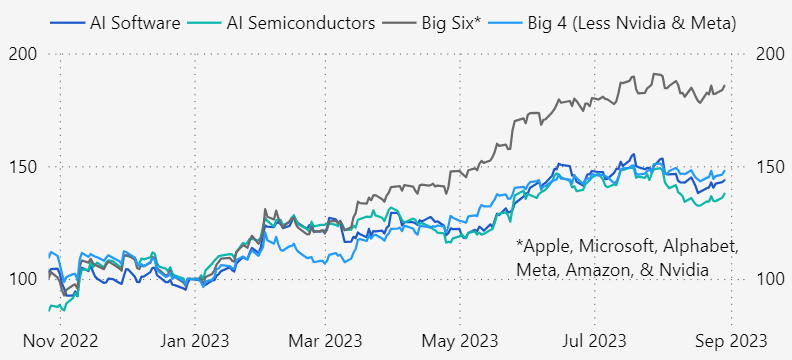

This has already been demonstrated in the sharp rise in share prices for the biggest technology firms and AI specialists in the first half of 2023, as hype around AI took off, outweighing concerns about overall slowing economic growth.

Industries based on repetitive tasks will likely automate roles using AI technologies, benefitting from increased precision and efficiency. And industries that make use of large datasets will be able to benefit from using AI tools to assist with more laborious tasks.

Even industries with less direct use for AI – for example, where roles require manual labor – are still likely to benefit indirectly as the gains from its adoption generally support the economy.

Financial markets in developed economies are poised to see the biggest impact on stock prices. The US is expected to see the most productivity gains from implementing AI technologies, and the majority of the firms at the heart of recent investor enthusiasm around AI are listed on US stock exchanges.

The US dominance of consumer technology markets in recent decades has led to the emergence of hubs such as Silicon Valley, which is attracting AI startups and offers the possibility that they could be acquired by tech giants. The number of AI startups receiving financing in the US has far exceeded any other country over the past decade. This head start in innovation is already beginning to play out in equity markets, establishing the US as a frontrunner.

Advanced economies in Asia, such as Hong Kong, Singapore, South Korea, and Taiwan, have typically adopted new technologies relatively quickly, which could help the region’s equity markets outperform — particularly given the large weighting of technology sectors in their stock indices.

Is AI Hype Creating a Stock Market Bubble?

The release of several high-profile generative AI tools in the past year has caused excitement among investors, as they have indicated the potential capabilities of AI. The share prices of companies specializing in AI software and semiconductor production, such as Nvidia, Meta, and C3.ai, have rallied by more than 100% since the launch of OpenAI’s ChatGPT in November 2022.

As mentioned above, the top technology companies have outperformed at a time when the rest of the stock market has come under pressure from concerns about slowing economic growth. Only a little over a quarter of the stocks in the S&P 500 Index of the largest US companies have risen by more than the overall index this year – the lowest proportion on record, according to Capital Economics.

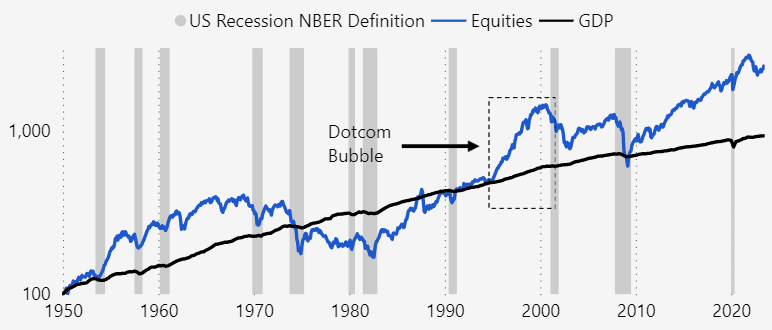

This raises the question of whether a speculative bubble may be forming surrounding AI-related stocks similar to the “dotcom bubble” that burst in 2000 after an excessive rally in Internet stocks. In fact, the last time the gains in the S&P 500 were limited to so few stocks was during that bubble, Capital Economics notes.

“Clearly AI has the potential to be a transformative technology which revolutionises how goods and services are produced and provided to consumers. But the extent of the current euphoria suggests that investors are wanting to crystallise the potential financial gains from the technology upfront.”

The formation and eventual bursting of an AI-related stock market bubble would largely affect US stocks, as European equities are receiving a limited boost given the few large technology companies in the region – with the exception of ASML and SAP.

This could hamper the ability of Europe’s stock markets to keep pace with the US market in the coming years, given that the success of large technology and telecom companies such as Nokia and Ericsson drove European equities higher during the dotcom bubble.

High-frequency trading and the increased role of social media in influencing market movements mean that markets tend to move faster than they did in the late 1990s.

All sectors of the S&P 500 performed well during the second half of that decade, even as the information technology (IT) sector outperformed. Capital Economics has taken the view that the AI revolution is likely to be similar. It expects the bubble “to last for a least two more years” and the stock market in general to rally as the bubble inflates: its 2024 and end-2025 forecasts for the S&P500 are 5,500 and 6,500, respectively.

It is worth noting, however, that the effect of tight monetary policy on economic growth could prevent a stock market bubble from inflating. Equities typically lose value during economic downturns, and IT has been the worst-performing sector on average in recent recessions.

“A period of slower growth could, therefore, cause enthusiasm around AI to wane temporarily. However, we envisage that this would take some air out of a bubble rather than causing one to burst.”

Regardless, the bursting of a bubble would be unlikely to prevent the AI revolution, any more than the bursting of the dotcom bubble halted the progress of the Internet. AI is also likely to have a lasting impact on the operations of businesses in many industries.

The Bottom Line

The impact of AI technologies in increasing productivity can result in a modest and gradual rise in real interest rates, which would keep real sovereign bond yields above the average level seen over the past decade.

Although higher real interest rates could weigh on stock prices overall, some equities are set to benefit from AI adoption as faster economic growth boosts company earnings.

Given the widespread applications for generative AI, most industries may experience share price gains. However, companies developing AI-focused software and hardware are set to benefit most, particularly in the near term.